Psychology of Money - Morgan Housel

Money’s greatest intrinsic value—and this can’t be overstated—is its ability to give you control over your time - Morgan Housel

The Psychology of Money is a deep dive into the relationship betwwn human behavious and money. The book offes a unque view over the money perspective which takes into cosideration the complexity of life.

How I discovered it

A while ago I decided to educate myself more when it comes to personal finances, economny and money. This was one of the books which popped out everywhere under all Must read recomandations.

Who should read it ?

This is a book with a phylosophy which applies to every generation. If you ever questions why people act different or in a certain way around money, this book will answer all our qestions about human behaviour and money.

Summary and impact on me

In the Phsychology of money the author brings experience to the table by offering examples of behaviors around money. Here are some of the most important lessons:

No one’s crazy: We all have a different view and experience with money and none of us is either wrong or correct.

Luck & Risk: You are one person in a game with seven billion other people and infinite moving parts. The accidental impact of actions outside your control can be more consequencial than the ones you consciouly take.

Never enough: There is no reason to risk what you have and need for what you don’t have and don’t need

Confounding compounding: Small steps consistently bring you further than big steps once in a while.

Getting wealthy & stalying wealthy: Being wealthy is not about the money, but rather than what can you do with them. Staying wealthy on the other side is about consistently not screwing up.

Tails, you win: Luck plays a much more important role in wealth that it is talked about.

Freedom: The highest form of wealth is the ability to wake up every morning and say ‘‘I can do whatever I want today’’

Man in the car paradox: You are the most important caratcher only in yoir story. No one is impressed with what you have as much as you are.

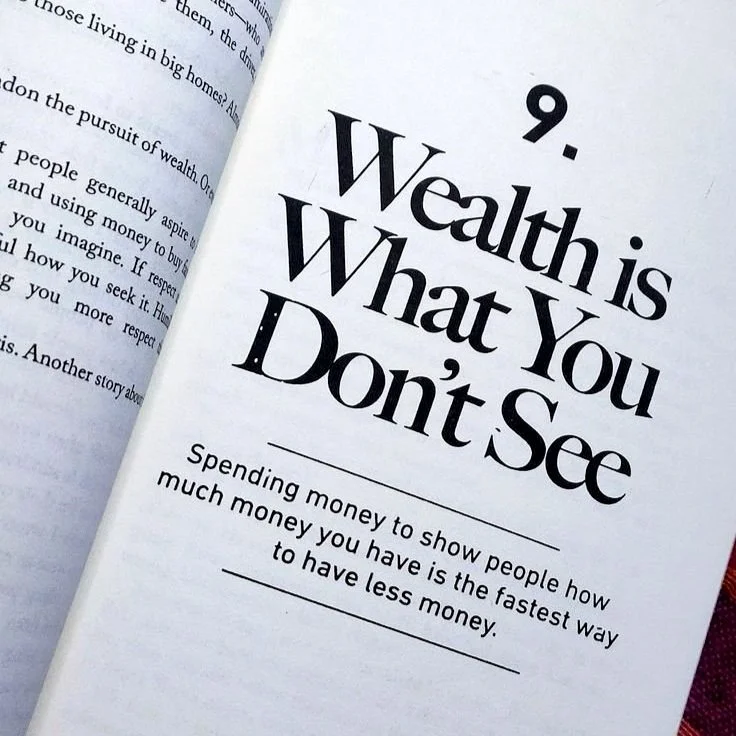

Wealth is what you don’t see: Wealth is not spending money on unnecesary things. Wealth is just the accumulated leftovers after you spend what you take in.

Save money: The secret to save money is consistent steps.

Reasonable > Rational: We are humas and have emotions. The best approach is to focus on being reasonable than purely logical and rational.

Room for erros: Always have a plan B and take into consideration when situations go the opposite way as planned

You will change: Humans change. But we do how the power in which direction to change.

Wothing’s free: Reals wealth and success come only work work, consistency and discipline.

Each chaper is unique and has a strong message through it’s examples.

How the book changed me

When chosing who I praise and admire I no longer take into consideration their success, but rather how they got there. Luck is a topic which is not discussed enough when talking about money. By the end of the book I felt more grounded when it comes to personal finances and understood better what are the real factors of growth.

Conclusion

In The Phsychology of money Morgan offers a fresh view on wealth. He addresses topics whch are often forgotten but play a major role. Definetly a must read!